Trading Psychology: Mastering the mind game to navigate risk and opportunity

For many, trading is just numbers and charts, but in fact it is also a mind game. Often, success in trading depends not only on mathematical analysis, but also on our emotions, the ability to control ourselves, make informed and considered decisions, and cope with stress.

The psychology of trading is the mental and emotional factors that influence our trading decision. Fear, greed, hope, regret, the desire to win quickly — all of them can damage our trading, decisions made on emotions typically turn out to be failures. We will discuss in the article how not to lose our head in the game and gain success in trading by avoiding impulsive decision-making in emotions.

Trading is not a simple matter and is often energy-consuming. Behind every successful trade there is a trader with certain character traits who knows how to make rational decisions in the face of unpredictable markets and manage his emotions.

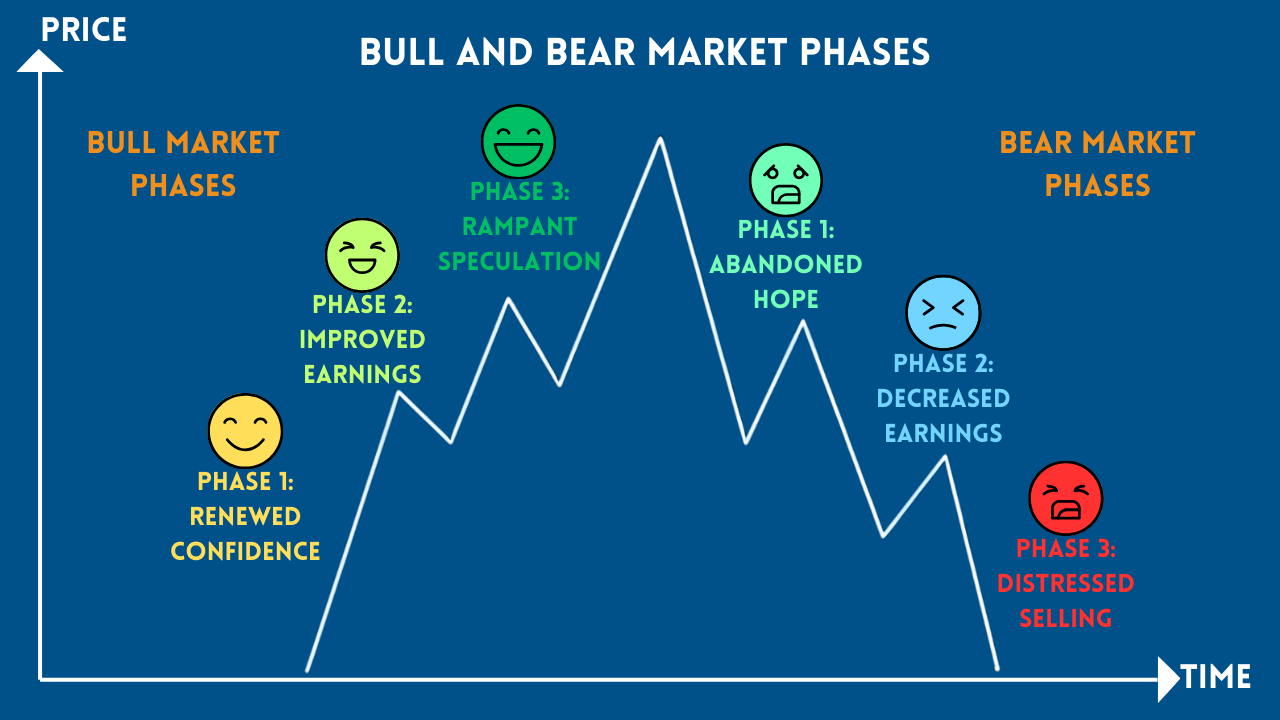

Emotions are our main enemy, they can easily control our body under stress, excitement, making rash, quick-tempered and often wrong decisions is often due to stress, short temper, a person makes a decision on emotions, not with a sober head. The fear of losses can lead to premature sales, which can lead to loss of profits. The desire to make instant profits can lead to risky trades and inappropriate investments. Successful transactions can lead to euphoria, which can lead to excessive optimism and risky decisions.

When trading becomes a part of your life, your life inevitably begins to have an impact on trading. The constant pursuit of profit and endless thoughts only about trading can negatively affect the psychological state, which can lead to anxiety disorder and other unpleasant diseases.

As a trader, you need to understand your emotions and way of thinking. This will help you identify when you are acting irrationally. And most importantly, learn to manage your emotions. There are some effective points:

- To keep your head clear and reduce emotional pressure, it is important to develop a trading strategy and include three indicators: entry price, stop level and profit target. Set limits, determine the maximum amount that you are willing to risk on a deal. It is important to understand that losses are part of trading, so allocate your finances wisely to avoid smaller losses in the future.

- Use technical analysis, namely, study charts, such as the EUR USD candlestick chart, to identify patterns and determine the direction of price movement.

- Be patient and take your time to enter into a deal. Wait for the right moment.

- Conduct regular analysis: check your trading strategy and make the necessary adjustments.

- Learn the basics of trading and the psychology of investing. There is a huge amount of psychological literature for traders that will show you how to deal with emotions.

- Join trading communities, share your experience, and look for new like-minded people.

Stress is the enemy of smart decisions. When it comes to your own pocket, it is difficult to be objective. Do not make important decisions on the verge of emotional stress and a surge of emotions. It is significant to distract yourself, calm down and then get back to business, decisions made on emotions can lead to wrong actions and a greater risk of losing finances.

Do not be afraid to contact specialists who will help you manage your emotions and teach you how to keep your mental state stable. The ability to manage your emotions is the foundation of successful trading. Self-awareness, emotional balance and progressive thinking all reflect the strong psychology of trading.

Conclusion

Trading psychology is an integral part of success in the market. The ability of a trader to understand the complexities of financial markets largely depends on the psychology of trading. Learn to manage emotions, make informed decisions wisely rather than under stress, and use resources that will help you improve your trading skills. Remember that trading is a marathon, not a sprint. Be patient, disciplined and persistent in your efforts, monitor the situation in the financial market and constantly educate yourself!